DDP & DDU: A Comprehensive Guide to Calculating Prices and Choosing the Right Method of Delivery

Introduction:

When it comes to international shipping, understanding the various terms and acronyms is crucial to ensure smooth and efficient operations. Among these terms, DDP (Delivered Duty Paid) and DDU (Delivered Duty Unpaid) hold significant importance. In this comprehensive guide, we will delve into the meaning of DDP and DDU, explain how to calculate their prices accurately, discuss the situations in which they should be used, and compare the benefits of shipping by truck and express delivery. By gaining a thorough understanding of these concepts, you will be equipped to make informed decisions and optimize your shipping operations, thereby enhancing your business's efficiency and customer satisfaction.

Understanding DDP and DDU in Shipping:

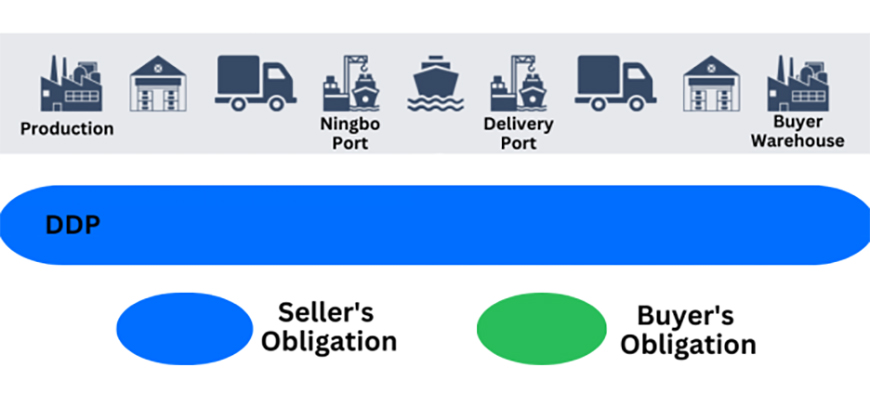

What is DDP?

DDP stands for Delivered Duty Paid. It is an incoterm that places the responsibility of all costs and risks associated with delivering goods to the buyer's location on the seller. Under DDP, the seller is responsible for customs clearance, import duties, taxes, and any other charges until the goods are delivered to the buyer. DDP provides a hassle-free experience for the buyer as they do not need to worry about additional costs or customs procedures.

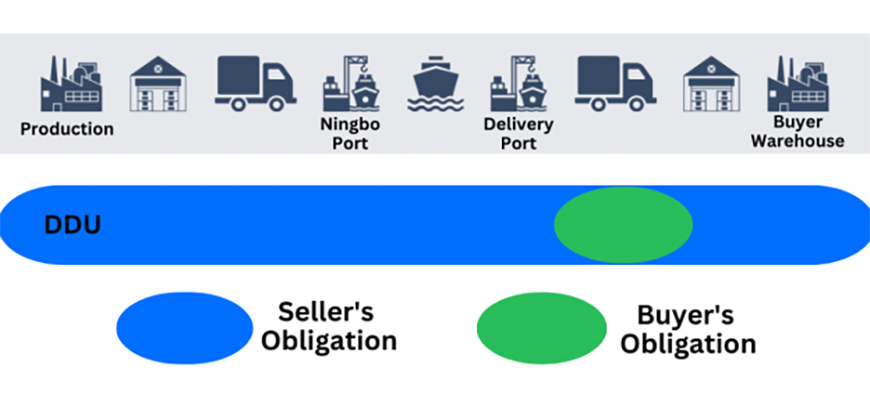

What is DDU?

DDU stands for Delivered Duty Unpaid. Unlike DDP, DDU places the responsibility of import duties, taxes, and customs clearance on the buyer. Under DDU, the seller is only responsible for delivering the goods to the agreed-upon destination, but the buyer must handle the customs procedures and pay any applicable charges upon arrival. DDU is often chosen when the buyer wants more control over the import process or has an established relationship with customs authorities.

How to Calculate DDP and DDU Prices?

Calculating DDP Prices:

Calculating DDP prices involves considering various factors such as the cost of goods, freight charges, insurance, import duties, and taxes. To illustrate the calculation, let's take an example of shipping goods from China to New York.

Suppose the cost of goods is $1,000, freight charges amount to $500, insurance costs $50, import duties are 10% of the goods' value, and taxes amount to 5% of the goods' value. To calculate the DDP price, you would use the following formula:

DDP Price = Cost of Goods + Freight Charges + Insurance + (Import Duties % * Cost of Goods) + (Taxes % * Cost of Goods)

In our example, the DDP price would be:

DDP Price = $1,000 + $500 + $50 + (10% * $1,000) + (5% * $1,000)

= $1,000 + $500 + $50 + $100 + $50

= $1,700

Therefore, the DDP price for shipping goods from China to New York would be $1,700.

Calculating DDU Prices:

Calculating DDU prices is relatively straightforward since the buyer is responsible for customs procedures and charges. The calculation involves considering the cost of goods, freight charges, and insurance. However, import duties and taxes are excluded from the calculation, as the buyer will handle them separately. Using the same example as above, the formula to calculate the DDU price would be:

DDU Price = Cost of Goods + Freight Charges + Insurance

In our case, the DDU price would be:

DDU Price = $1,000 + $500 + $50

= $1,550

Hence, the DDU price for shipping goods from China to New York would be $1,550.

When to Use DDP and DDU in Shipping?

When to Use DDP?

DDP is generally preferred when the buyer wants a hassle-free shipping experience and wishes to minimize their involvement in customs procedures. This incoterm is suitable for buyers who may be unfamiliar with the complexities of international shipping or who simply want to avoid any unexpected costs or delays that may arise during the customs clearance process. By opting for DDP, the buyer can rely on the expertise of the seller, who will handle all the necessary paperwork, pay import duties and taxes, and ensure a smooth delivery to the buyer's location.

In addition, DDP can be particularly beneficial when the seller has extensive experience in international shipping and a well-established network of customs brokers. Such expertise allows the seller to efficiently navigate through the complexities of customs clearance, reducing the risk of delays and potential errors. Moreover, DDP provides the buyer with a predictable total cost for shipping, as all expenses associated with import duties, taxes, and customs procedures are included in the initial price.

When to Use DDU?

While DDP offers convenience and simplicity, DDU (Delivered Duty Unpaid) may be a more suitable option in certain circumstances. DDU places the responsibility of customs procedures, import duties, and taxes on the buyer. This incoterm is often chosen when the buyer wants more control over the import process and prefers to directly manage customs clearance and associated costs.

DDU can be advantageous for buyers who have an established relationship with customs authorities or possess in-depth knowledge of import regulations. By taking charge of customs procedures themselves, buyers can ensure compliance with specific requirements and potentially expedite the clearance process. Additionally, some buyers may choose DDU to optimize costs, as they can negotiate import duties and taxes directly with customs authorities or utilize specific duty reduction programs.

However, it's important to note that opting for DDU requires the buyer to thoroughly understand and comply with the customs regulations of the destination country. It involves additional responsibilities and potential risks, such as potential delays due to customs procedures or the need to resolve any customs-related issues independently. Therefore, buyers considering DDU should have the necessary expertise and resources to handle these complexities effectively.

Ultimately, the choice between DDP and DDU depends on the buyer's specific needs, preferences, and level of involvement in the shipping and customs processes. Careful consideration of factors such as familiarity with customs procedures, control over the import process, and desired level of engagement will help determine which incoterm is most suitable for a particular shipment.

Choosing the Right Mode of Transportation:

Benefits of Shipping by Truck:

Shipping goods by truck offers several advantages. Firstly, it provides flexibility in terms of pickup and delivery locations, especially for shipments within a specific region. Additionally, trucking services are often cost-effective for short to medium distances. Trucks can navigate various terrains and reach destinations that may be inaccessible by other modes of transportation. Furthermore, trucking offers faster transit times compared to other modes of transportation, such as sea freight.

Benefits of Shipping by Express:

Express shipping, typically through air freight, offers speed and reliability. It is ideal for urgent deliveries or time-sensitive goods. Express shipments are usually handled with high priority, ensuring faster transit times. Moreover, express carriers provide excellent tracking capabilities, allowing shippers and recipients to monitor the shipment's progress in real time. Although express shipping can be more expensive than other modes, it offers convenience and efficiency for time-critical shipments.

Conclusion:

Understanding the meaning of DDP and DDU in shipping is crucial for international traders. By calculating DDP and DDU prices accurately, businesses can optimize their costs and make informed decisions regarding the method of delivery. Whether choosing DDP or DDU, it is essential to consider factors such as familiarity with customs procedures, control over the import process, and desired level of involvement. Additionally, selecting the appropriate mode of transportation, be it truck or express, can significantly impact the efficiency and speed of shipping operations. By considering these factors, businesses can streamline their shipping processes and enhance customer satisfaction.