Demystifying Letter of Credit: A Comprehensive Guide for International Trade

Introduction:

In today's interconnected global economy, international trade plays a pivotal role in driving economic growth. However, conducting business across borders can be complex and carries inherent risks. To mitigate these risks and ensure smooth transactions, various financial instruments are employed. One such instrument is the letter of credit. This article aims to demystify the concept of a letter of credit, providing valuable insights into its process, types, and benefits. By delving into real-life examples from China and New York, we will illustrate the practical applications of this vital tool.

What is a Letter of Credit?

A letter of credit is a legally binding document issued by a financial institution, typically a bank, that guarantees payment to a seller (beneficiary) once certain conditions are met. It serves as a written commitment, assuring the seller that they will receive payment for goods or services rendered. Essentially, a letter of credit acts as a risk-mitigation tool for both buyers and sellers in international trade.

The Process of a Letter of Credit:

The letter of credit process involves several key players, each with specific roles and responsibilities. Let's explore these roles in detail.

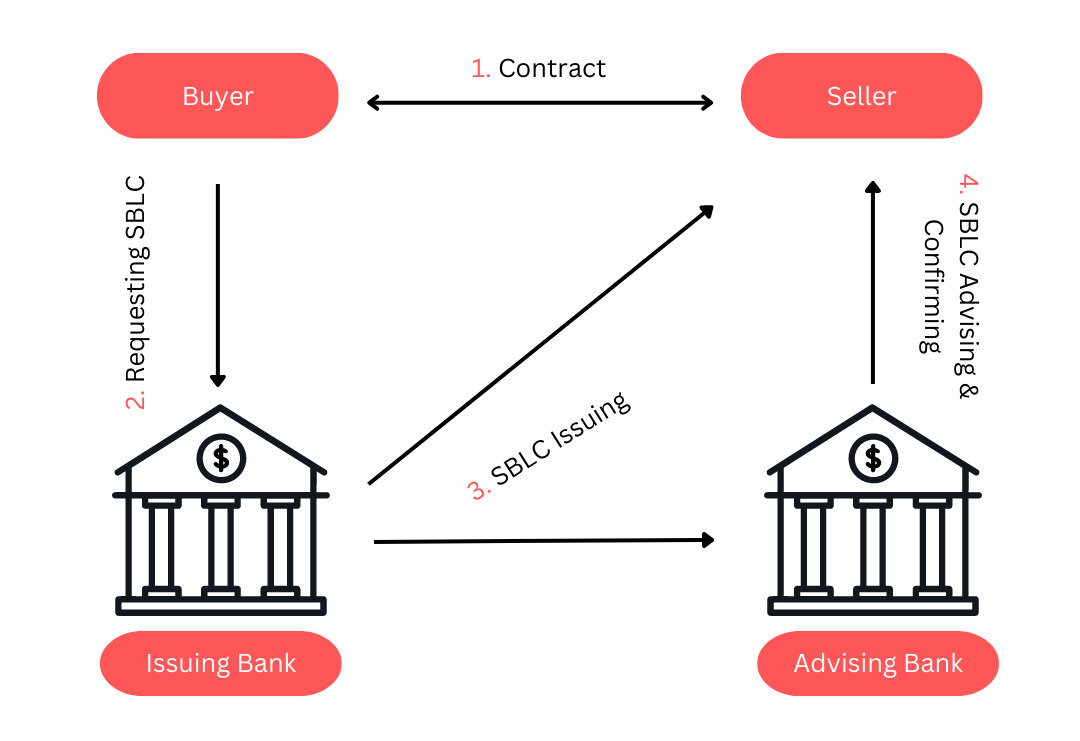

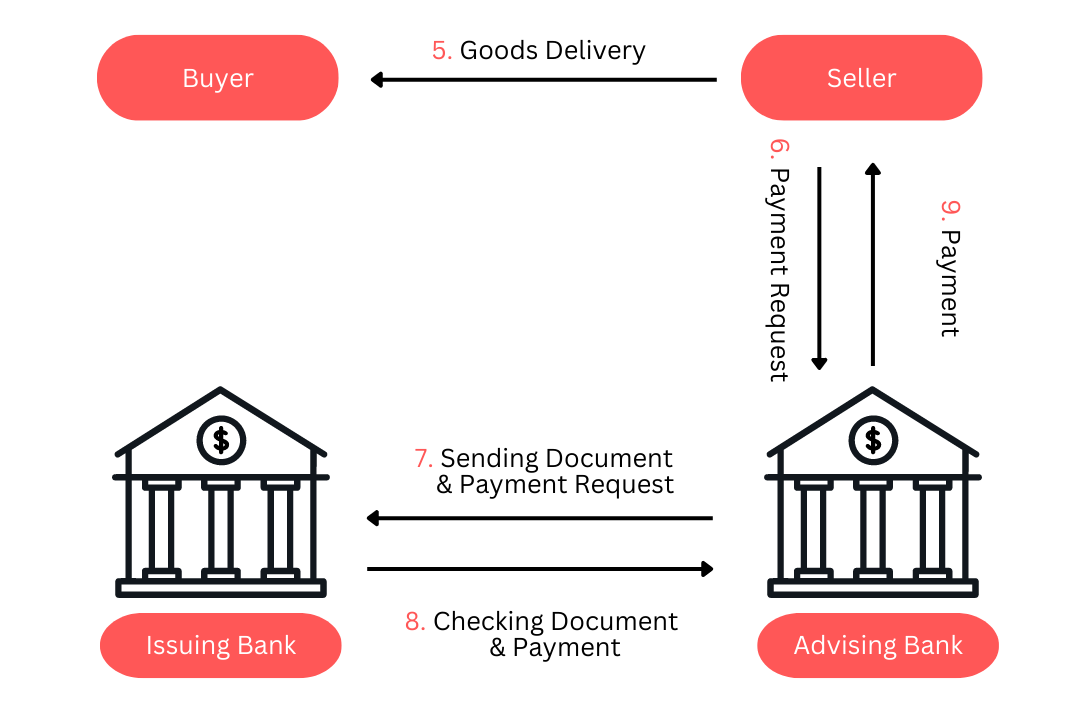

Opening a Letter of Credit:

The process begins when the buyer (applicant) requests their bank, known as the issuing bank, to open a letter of credit in favor of the seller. The buyer and seller agree upon the terms and conditions outlined in the letter of credit, including the amount, documents required for payment, and shipment details.

Issuing Bank's Role:

Upon receiving the buyer's request, the issuing bank evaluates the buyer's creditworthiness and, if approved, issues the letter of credit. The issuing bank assumes the primary obligation to honor the payment to the seller as long as the terms and conditions are met.

Beneficiary's Role:

Once the letter of credit is opened, the seller, also known as the beneficiary, is informed by their bank, the advising bank, of the letter of credit's existence and terms. The seller can then prepare the required documents and initiate the shipment process.

Advising Bank's Role:

The advising bank, located in the seller's country, acts as an intermediary, verifying the authenticity of the letter of credit and advising the seller of its content. The advising bank does not assume any liability unless it confirms the letter of credit.

Confirming Bank's Role:

In some cases, particularly when dealing with unfamiliar or high-risk markets, the seller may request a confirming bank to provide an additional level of assurance. The confirming bank, typically located in the seller's country, adds its confirmation to the letter of credit, guaranteeing payment to the seller independently of the issuing bank.

Types of Letters of Credit:

Letters of credit can be classified into various types based on different criteria. Understanding these types is crucial for choosing the most appropriate letter of credit for a specific trade transaction. Let's explore the main types:

Revocable vs. Irrevocable:

Revocable letters of credit can be modified or canceled without prior notice, leaving the seller exposed to payment risks. On the other hand, irrevocable letters of credit provide greater security as they cannot be changed or revoked without the consent of all parties involved.

Confirmed vs. Unconfirmed:

Confirmed letters of credit include the involvement of a confirming bank, offering an additional layer of security to the seller. Unconfirmed letters of credit rely solely on the issuing bank's obligation to honor payment.

Sight vs. Time:

Sight letters of credit require immediate payment upon presentation of compliant documents. Time letters of credit, also known as usance letters of credit, allow for deferred payment, usually after a specified period.

Transferable vs. Non-Transferable:

Transferable letters of credit enable the seller to transfer a portion or the entire credit amount to one or more secondary beneficiaries. Non-transferable letters of credit restrict this transferability.

Standby Letters of Credit:

Standby letters of credit serve as a backup payment method, ensuring compensation to the beneficiary if the buyer fails to fulfill their obligations. They are commonly used in non-trade-related scenarios, such as construction projects or lease agreements.

Benefits of Letters of Credit:

Letters of credit offer significant benefits for both buyers and sellers in international trade. Let's examine these benefits from each perspective:

Seller's Perspective:

For sellers, letters of credit assure payment, reducing the risk of non-payment or delayed payment. By adhering to the terms and conditions of the letter of credit, sellers can confidently fulfill their contractual obligations and safeguard their financial interests.

Buyer's Perspective:

Buyers also benefit from letters of credit, as they provide a mechanism to ensure that goods or services are delivered as agreed upon. By stipulating the necessary documents and conditions, buyers can maintain control over the payment process and mitigate the risk of receiving substandard or non-compliant goods.

Conclusion:

In the intricate landscape of international trade, the letter of credit stands as a vital financial instrument, ensuring secure transactions and mitigating risks for both buyers and sellers. By understanding the process, types, and benefits of letters of credit, businesses can navigate the complexities of global trade with confidence. Whether it's facilitating trade between China and the United States or New York and Italy, the letter of credit remains a cornerstone of international commerce, fostering trust and enabling economic growth.