Exploring CIP Incoterms: Responsibilities, Advantages & Disadvantages

Introduction:

When it comes to international trade, having a clear understanding of the various Incoterms is essential. One such term that plays a significant role in facilitating global commerce is CIP, which stands for Carriage and Insurance Paid to. This article aims to provide a comprehensive understanding of CIP Incoterms, focusing on the responsibilities of buyers and sellers within CIP agreements. Additionally, we will explore the advantages and disadvantages for both parties, compare CIP with other Incoterms such as DAP and CIF, and provide a price calculation example to demonstrate how CIP works in practice.

Understanding CIP Incoterms:

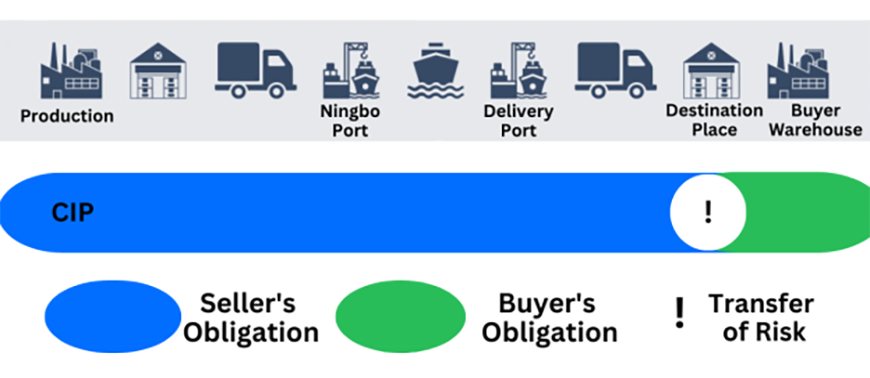

CIP is an Incoterm established by the International Chamber of Commerce (ICC) to define the point at which the seller fulfills their delivery obligations to the buyer.

CIP Incoterms specify that the seller is responsible for arranging and paying for the main carriage of the goods to the agreed-upon destination. This means that the seller takes on the responsibility of selecting a reliable carrier, arranging for transportation, and ensuring that the goods reach the buyer's specified location. Additionally, under CIP agreements, the seller must provide insurance coverage for the goods during transit to protect against potential loss or damage.

Buyers and Sellers Responsibilities with CIP Agreements:

CIP Incoterms provide a standardized framework that allows for clarity and transparency in international trade transactions. By clearly defining the responsibilities of the buyer and seller, CIP agreements help mitigate risks and ensure smooth operations.

In a CIP agreement, both the buyer and the seller have specific responsibilities. The seller's responsibilities include arranging and paying for the main carriage of the goods to the agreed-upon destination. This entails selecting a reliable carrier and ensuring that the goods are delivered within the specified timeframe. Additionally, the seller is responsible for obtaining insurance coverage for the goods during transit, protecting against potential losses or damages.

On the other hand, the buyer's responsibilities in a CIP agreement involve accepting the delivery of the goods at the agreed-upon destination. The buyer must also coordinate with the seller to provide necessary information for insurance purposes. Furthermore, the buyer should promptly inspect the goods upon arrival and notify the seller of any issues or discrepancies.

Advantages of CIP Agreements for Buyers and Sellers:

CIP (Carriage and Insurance Paid to) Incoterms play a crucial role in international trade, providing a standardized framework for the responsibilities and obligations of buyers and sellers. In this chapter, we will explore the advantages of CIP agreements for both buyers and sellers. Understanding these benefits is essential for optimizing trade operations, mitigating risks, and building strong business relationships:

Reduced Risk and Financial Burden:

Buyers: CIP agreements reduce the risk and financial burden for buyers as the seller takes on the responsibility of arranging and paying for transportation and insurance. This ensures that the goods are delivered safely and provides peace of mind.

Sellers: By assuming the responsibility for transportation and insurance, sellers can mitigate risks and minimize financial burdens for buyers. This enhances customer satisfaction and builds trust.

Streamlined Logistics:

Buyers: With sellers taking care of transportation and insurance, buyers can focus on other aspects of their business operations, streamlining the logistics process and allowing for greater efficiency.

Sellers: By managing the logistics aspects, sellers have better control over the transportation process, ensuring timely delivery and smoother operations.

Enhanced Customer Satisfaction:

Buyers: The seller's responsibility for arranging transportation and insurance ensures that buyers receive their goods in a timely and secure manner, leading to increased satisfaction and a positive customer experience.

Sellers: By providing transportation and insurance services, sellers can deliver a seamless experience to buyers, resulting in enhanced customer satisfaction, repeat business, and potential referrals.

Building Trust and Relationships:

Buyers: CIP agreements enable buyers to rely on the expertise and reliability of the seller in handling transportation and insurance. This fosters trust and strengthens the buyer-seller relationship.

Sellers: By assuming responsibility for transportation and insurance, sellers can build trust and establish stronger relationships with buyers. Providing comprehensive services showcases professionalism and commitment.

Control over Logistics:

Buyers: While the seller arranges transportation, buyers can still have control over other aspects, such as customs clearance and final delivery. This allows buyers to manage the goods' flow efficiently and align with their specific requirements.

Sellers: Taking charge of transportation and insurance gives sellers greater control over the logistics process, allowing them to choose reliable carriers, optimize costs, and ensure the goods' safe delivery.

It is important for both buyers and sellers to carefully consider these advantages when engaging in CIP agreements. By leveraging the benefits, parties can optimize their international trade operations, mitigate risks, and foster successful business partnerships.

Disadvantages of CIP Agreements for Buyers and Sellers:

While CIP (Carriage and Insurance Paid To) Incoterms offer advantages for buyers and sellers, it is crucial to be aware of the potential disadvantages as well. In this chapter, we will explore the disadvantages of CIP agreements from the perspectives of both buyers and sellers. Understanding these challenges enables stakeholders to make informed decisions and address potential drawbacks effectively.

Limited Control over Transportation:

Buyers: As the seller is responsible for arranging the main carriage, buyers may have limited visibility and influence over the transportation process. This lack of control can affect delivery timelines and overall customer satisfaction.

Sellers: Sellers may face challenges in managing transportation, including carrier selection, coordination, and potential delays. Limited control over transportation can impact the seller's ability to meet buyer expectations.

Potential Challenges in Customs Clearance:

Buyers: Despite the seller's responsibility for transportation and insurance, buyers still need to handle customs clearance, duties, and taxes. Navigating the complexities of customs procedures can be time-consuming, costly, and subject to potential delays.

Sellers: Sellers must consider the potential complexities associated with customs clearance, which can affect the overall efficiency of the transaction. Additionally, any delays or issues in customs clearance may lead to dissatisfaction on the buyer's side.

Increased Responsibility and Complexity:

Buyers: While buyers benefit from reduced risk and financial burdens, they may need to rely on the seller's expertise and assume additional responsibilities for customs procedures, duties, and taxes. This can add complexity and administrative burden to the buyer's operations.

Sellers: Sellers bear the responsibility of arranging transportation and insurance, which can be time-consuming and require expertise. Handling potential claims in case of loss or damage can further increase the complexity of the transaction.

Potential Higher Costs:

Buyers: While the seller assumes transportation and insurance costs, buyers should consider that these expenses are factored into the total price of the goods. Thus, the cost of goods under CIP agreements may be higher compared to other Incoterms where buyers bear these expenses separately.

Sellers: Sellers need to carefully consider the additional costs associated with arranging transportation and insurance. These costs, along with potential risks and the need for expertise, can impact the profitability of the transaction.

By understanding these potential disadvantages, buyers and sellers can proactively address them to minimize their impact. Effective communication, collaboration, and a thorough understanding of roles and responsibilities can help mitigate the challenges and foster successful CIP agreements.

CIP, DAP, and CIF: A Comparison

To better understand CIP Incoterms, it's essential to compare them with other related Incoterms. Two notable terms to consider are DAP (Delivered at Place) and CIF (Cost, Insurance, and Freight).

CIP vs. DAP: The key difference between CIP and DAP lies in insurance coverage. While both terms require the seller to arrange and pay for the main carriage, CIP places the responsibility on the seller to provide insurance coverage. In contrast, under DAP, the buyer is responsible for insurance. This distinction impacts the risk allocation between the parties.

CIP vs. CIF: CIP and CIF share similarities in that both require the seller to arrange and pay for the main carriage and insurance. However, CIF goes a step further by also requiring the seller to handle the cost of freight. This additional cost coverage in CIF may result in higher total costs for the seller compared to CIP.

Price Calculation Example: China and New York:

To understand the price calculation involved in a CIP agreement, let's consider an example involving shipping goods from China to New York. Suppose the total cost of the goods is $10,000, the packaging and handling costs amount to $500, and the transportation and insurance costs from China to New York are $1,500. In this scenario, the total price for the buyer would be $10,000 + $500 + $1,500 = $12,000.

The formula for price calculation in a CIP agreement can be summarized as follows:

Total Price = Cost of Goods + Packaging and Handling Costs + Transportation and Insurance Costs

Buyers and sellers need to understand this formula and consider all relevant costs associated with a CIP agreement to accurately calculate the total price.

Conclusion:

In conclusion, understanding CIP Incoterms is vital for buyers and sellers engaged in international trade. With its defined responsibilities and insurance coverage, CIP agreements provide clarity and a standardized framework for successful transactions. While there are advantages and disadvantages to consider, CIP offers risk reduction for buyers and cost optimization opportunities for sellers. By comparing CIP with other Incoterms like DAP and CIF, stakeholders can make informed decisions and select the most suitable terms for their specific trade needs. Additionally, comprehending the price calculation formula and examples enables parties to accurately estimate the total costs involved in a CIP agreement. By mastering the intricacies of CIP Incoterms, buyers and sellers can enhance their international trade operations and ensure smooth transactions in the global marketplace.